Legal & Credits (Switzerland)

Privacy Policy

1. Introduction

This Privacy Policy gives you an overview of the processing of your personal data by CBH Compagnie Bancaire Helvétique (“we”; “CBH”; “the Bank”) and your rights under data protection law.

The specific data that is processed and the way it is used depends on the Client’s requests and the services provided.

2. Data sources and types

The Bank processes the data received from its Clients and generated in the scope of the business relationship with them. This involves personal data, i.e., data that allows you to be directly identified as a Client (for example, name, address, contact details, date and place of birth, etc.) or data that permits identification when used in conjunction with other information (for example, bank account number). In addition to data received directly from Clients, we process – insofar as this is necessary to provide our services – personal data that we obtain in an authorized manner from publicly accessible sources (e.g. land registers, commerce registry, press, Internet) or which is provided to us by other companies of the CBH Group or by third parties (for example, a credit agency or other cooperation partners).

The following personal data may be processed by the Bank:

• Personal data (name, address, email, date of birth)

• Identification data (data from documents of identification)

• Data resulting from the performance of obligations (e.g. signature)

• Information about your financial situation (for example, data on scores and ratings, data on solvency)

• Data relating to orders and orders placed (for example, payment orders)

• Advertising and sales data

• Data recording (for example, consultation protocol)

• Other data comparable to the above categories

With regard to the data processed when using digital services (“digital channels”), we refer to additional information on data protection in relation to the service or application concerned on a case-by-case basis.

3. Purpose of data collection and legal basis

The Bank collects personal data for the purposes and on the legal basis hereafter, in accordance with the applicable data protection regulations:

a) For the performance of contractual obligations

Data processing is done for the purpose of providing banking transactions and financial services in the scope of the execution of our contracts with our Clients or for the execution of pre-contractual measures, which are performed on request. The purposes of the data processing are mainly based on the specific product (e.g., account, loan, securities, deposits, brokerage) and may include, among others, an analysis of the needs, advice, management and support of assets, and the execution of transactions. You will find more information on the purposes of data processing in the contractual documents and the applicable Terms and Conditions.

b) As part of the balancing of interests

If necessary, the Bank will process your data beyond the limits of performance of the contract in order to protect its legitimate interests or the legitimate interests of third parties, for example:

• Prevention and/or investigation of criminal acts

• Risk management (for example, the calculation of eligible capital requirements for banks) within the Bank and the CBH Group

• Consultation and exchange of data with authorized agents (for example, debt collection registers) for the determination of solvency and the risk of credit default or, if necessary, in the case of protection accounts against seizures or basic accounts

• The support of legal claims and defence of interests in the event of a dispute

• Advertising, market research or surveys, unless you have expressly refused

• Protection of IT security and the Bank’s IT operations

• Video surveillance for the protection of access rights, the collection of evidence in cases of bank theft or the prevention of fraud

• Testing and optimization of processes for needs analysis or contact with the Client

• The collection of personal data from sources available in the public domain for the purposes of market research and business development

• Measures to ensure the security of buildings and systems (e.g., entry controls)

• Measures for the purposes of business management and the development of new services and/or products.

c) Based on your consent

If you have given us your consent for the processing of personal data for specific purposes, the lawfulness of this processing is based on your consent. Any consent granted can be revoked at any time. The withdrawal of consent does not have retroactive effect on the use of your data.

d) Based on legal requirements or in the public interest

The activities of the Bank are subject to various regulations and requirements (for example, the Swiss Banking Act, the Collective Investment Schemes Act, the Anti Money Laundering Act, the Mortgage Bond Act, tax law, the directives of the Swiss Bankers Association), as well as other directives and regulatory requirements specific to banks (for example, the Swiss National Bank and FINMA – Swiss Financial Market Supervisory Authority –). The data processing is used, among other things, to verify solvency, as well as identity and age, to prevent fraud and money laundering, for compliance with monitoring and reporting obligations in tax matters, as well as risk assessment and management within the CBH Group.

4. Access to your personal data

Within the Bank, access to your data is granted to organizations that need it to fulfil our contractual and legal obligations. Service providers and agents employed by the Bank (other legal entities of the CBH Group or third parties) may also receive data for these purposes. The use of service providers (notably subcontractors) is in accordance with the provisions of the Swiss Banking Act and of the Data Protection Act. For example, external service providers are, in turn, required to respect banking secrecy and the requirements of data protection law. These are companies that provide services, notably in the following categories: IT, payment transactions, securities’ settlement, credit risk management, asset recovery, telecommunications, logistics, printing and sending of bank documents, advisory and consulting services, as well as marketing and sales.

The Bank only transmits information concerning you or makes it available to third parties if there is a legal basis, if you have given your consent, or if the Bank is authorized to provide banking information. Under these conditions, the recipients of personal data may be, for example:

• Public bodies and institutions (for example, prosecution authorities, supervisory authorities, debt and bankruptcy agencies, inheritance authorities);

• Other credit and financial services institutions or comparable institutions to which the Bank transfers personal data in order to conduct the business relationship with you (for example, correspondent banks, custodian banks, brokers, stock exchanges);

• Other companies in the CBH Group for risk management purposes due to legal or official obligations or on the basis of your consent.

5. Transfer of data

The Bank transfers your data to countries other than Switzerland (so-called third countries) (i) if it is necessary to execute your orders (for example payment orders and securities orders), (ii) if it is required by law (e.g., tax reporting obligations) or (iii) if you have given us your consent.

For data transferred abroad, Swiss law is not applicable. These transfers are, however, secured by corresponding guarantees to ensure an appropriate level of data protection.

6. Period of retention

We only keep your personal data for as long as necessary to fulfil the purpose for which it was collected, taking into account our legitimate interest in keeping it, for example to respond to requests of information or to resolve problems, or to comply with our legal and regulatory obligations.

If the data is no longer necessary for the performance of contractual or legal obligations, it will be deleted at regular intervals, unless it is necessary for temporary further processing, for example:

• For the fulfilment of archiving obligations provided for by contract law and tax law (for example under the Code of Obligations, the Federal Act on Value Added Tax, the Federal Act on Direct Federal Taxation, the Federal Act on Harmonisation of Direct Taxes of Cantons and Municipalities, the Federal Stamp Duty Act and the Federal Withholding Tax Act);

• For compliance with specific regulations which oblige the Bank to keep data for an indefinite period, for example if a case of litigation is anticipated.

7. Your data protection rights

All data subjects have the following rights:

• Right of access;

• Right of rectification;

• Right of erasure (“right to be forgotten”);

• Right to limit processing;

• Right of objection;

• Right of portability of data.

You also have a right of recourse with a data protection supervisory authority. You can revoke your consent for the processing of personal data at any time by contacting us. Please note that such revocation is only effective for the future. The processing that took place before the revocation is not affected.

8. Data necessary for establishing a business relationship

In the scope of our business relationship, you must provide the Bank with the personal data necessary for the establishment and execution of a business relationship and for compliance with the associated contractual obligations or which we are legally required to collect. Without this data, we will generally not be able to establish the contract with you or provide the services or products that you have requested.

In particular, the Anti Money Laundering Act requires us to identify you with your document of identification before establishing the business relationship and to collect and record details such as your name, place and date of birth, nationality, address and other identifying data. In order for us to comply with this legal obligation, you must provide the necessary information and documents in accordance with the Anti Money Laundering Act and immediately notify us of any changes occurring during the business relationship.

9. Automated decision making and profiling

In principle, we do not use a fully automated decision-making process to establish and conduct business relationships. If we were to use such a process, we would notify you separately if required by law.

Furthermore, in principle, we do not automatically process personal data for the purpose of assessing certain aspects of personality (profiling). However, we sometimes resort to profiling, for example in the following cases:

• Due to legal and regulatory requirements, CBH is obliged to take measures to combat money laundering, terrorism financing, fraud and financial crime. Data evaluations (including on payment transactions) are also carried out in this context. At the same time, these measures also serve to protect you.

CBH reserves the right to further analyze and evaluate personal data in an automated manner in the future, in order to identify significant personal characteristics about you or to predict developments and to create Client profiles. In particular, these may be used for controls related to commercial activity, individual management, advisory or financial services and the supply of offers and information that CBH can make available to you.

10. Biometric data

Biometric data is personal data of a particularly sensitive nature. As a result, if necessary, the Bank will obtain separate and explicit consent before using any biometric identification element to access certain applications or uses.

11. Contact details of the Data Protection officer – DPO

CBH Compagnie Bancaire Helvétique SA

Data Protection Officer

Boulevard Emile-Jaques-Dalcroze 7

1204 Genève

dpo@cbhbank.com

12. Policy change and contact details

This policy is regularly reviewed and may be updated at any time without notice. If you have any questions regarding the processing of your data, please contact either your Relationship Manager or the Bank’s data protection officer, who will be happy to help you.

Last review: March 2022

Cookie Policy

CBH Compagnie Bancaire Helvétique takes the private nature of your personal data very seriously.

On this page you can learn everything about the use of cookies on our website.

What is a cookie?

We use cookies on our corporate website (www.cbhbank.com) and our local websites to improve your online experience when using our services.

Cookies are small text files that are stored on your computer, smartphone or other devices when you access a website. They allow to recognize your device, to adapt the navigation and content to your preferences, to improve the performance and to collect statistics, helping us to continuously enhance our services to you.

What type of cookie do we use?

Necessary cookies (functional cookies)

These cookies are indispensable for the running of our website, especially for managing your sessions and our systems. They make easier for you to access content of our website, securely, by storing for example your language settings. They cannot be deactivated.

How can you control, disable or block cookie?

You can customize or change your cookie settings at any time according to your preferences.

Customize cookie settings

There are a number of ways in which you can manage your cookie preferences depending on the browser or device you are accessing our services from. To know more, please refer to the « Help » button (or similar) on your browser.

You can find below the instructions for the most commonly used browsers:

Internet Explorer/Microsoft Edge

However, please remember that cookies are often used to enable and improve certain functions. If you choose to switch some cookies off, it is likely to affect our website.

Cookie policy changes

We reserve the right to change and modify this Cookie Policy without notice. If we do, we will post the amended Policy on our website and invite you to check this page regularly.

Last review: January 2022

Federal Act on Financial Services (FinSA)

1. General information: objectives of the law

The Federal Act on Financial Services entered into force on January 1, 2020 and it aims to:

• strengthen the protection of investors;

• define rules of conduct regarding the offering of financial instruments and the provision of financial services

• create a level playing field among financial services providers.

2. Scope of application and identification of the financial services provider

The FinSA applies to all financial services providers (“FSPs”) operating in a professional capacity, which includes banks and issuers and suppliers of financial instruments in Switzerland. Most of FinSA’s provisions benefit from a transitional period until January 1, 2022.

In this context, CBH Compagnie Bancaire Helvétique SA (“CBH” or “the Bank”) is subject to the FinSA. The address of the Bank’s registered office is:

CBH Compagnie Bancaire Helvétique SA

Boulevard Emile-Jaques-Dalcroze 7

1204 Geneva

CBH is duly licensed as a bank and securities house and is subject to the supervision of the Swiss Financial Market Supervisory Authority (FINMA – Laupenstrasse 27, 3003 Bern). In addition, CBH is a member of the Swiss Bankers Association and the Swiss Deposit Guarantee Association for Banks and Securities Dealers.

CBH is an independent, family-owned private bank, and focuses on asset management for private and institutional clients. CBH therefore offers wealth and asset management services as well as Family Office solutions.

The FinSA thus applies to CBH since it provides the following financial services:

• the purchase or sale of financial instruments,

• the receipt and transmission of orders for financial instruments,

• asset management,

• investment advice,

• granting credit for transactions in financial instruments.

3. Client classification

The Bank collects personal data for the purposes and on the legal basis hereafter, in accordance with the applicable data protection regulations:

The FinSA provides for the obligation for the institutions subject to it to classify their clients in one of the following three categories: “private” clients, “professional” clients, “institutional” clients.

Classification | Signification |

“Private” Clients | • Clients who are neither professional nor institutional |

“Professional” Clients | • Deemed to be able to make informed investment decisions |

“Institutional" Clients | • Have knowledge and experience comparable to that of financial services providers |

Clients are automatically classified in one of these 3 categories of clients, by legal obligation, but they can request a change of classification (Opting-in/Opting-out, see next point 4):

Private Clients | Professional Clients | Institutional Clients |

Non-professional or non-institutional Clients, including professional Clients who have opted in | • Public law institutions with a professional treasury | • Financial intermediaries |

4. Change in classification

The FinSA provides for the possibility to change category, upon written request by the client, and provided that the required conditions are met.

4.1 Change to a more limited protection category (opting out)

A “private” client may apply to be considered a “professional” client in the following cases:

• The client has (1) assets of at least CHF 500,000 and (2) the knowledge necessary to understand the risks of investments, thanks to personal training and professional experience or comparable experience in the financial sector

or

• The client has assets of at least CHF 2 million.

Direct investments in real estate, social insurance claims and occupational pension assets are excluded from the above amounts.

The following clients may apply to be considered as “institutional” clients:

• Swiss or foreign collective investment schemes (or their management companies), not subject to prudential supervision;

• Companies, pension funds and other institutions serving occupational pension purposes, provided they have a professional treasury.

4.2 Change to a category offering broader protection (opting in)

• A “professional” client may request to be treated as a “private” client.

• An “institutional” client may request to be treated as a “professional” client.

5. Code of conduct

Rules of conduct are an important element of investor protection. For this reason, the FinSA obliges FSPs to comply with the obligations under supervisory law when providing financial services to “private” and “professional” clients. These rules of conduct therefore do not apply to “institutional” clients.

5.1 Obligation to inform

In order to meet this information obligation, the FSP shall, in particular, make available to their clients (i) information concerning the FSP (e.g. via an information brochure detailing its name, address, field of activity, etc.) and (ii) information on the financial services that the FSP may provide.

All of this information regarding CBH can be found below, under points 7, 8 and 9. The Bank’s presentation brochure is available to clients on demand. In addition, all relevant information is also available on the CBH website: www.cbhbank.com

In addition, the FSP informs its clients about financial services, costs, products and risks. In particular, clients are informed about (i) the financial service which is the subject of the personalized recommendation and the related risks and costs, (ii) the economic relations of the FSP with third parties with respect to the financial service concerned and (iii) the market offer taken into account for the selection of financial instruments by the FSP.

In addition, a Basic Information Sheet (“BIS”) on financial instruments is made available to “private” clients when the acquisition of these instruments is not carried out within the framework of a discretionary management mandate. Thus, in the scope of personalized recommendations, the BIS enables clients to obtain information on the characteristics, risks and costs of the financial instrument concerned, allowing for an easier comparison between the various financial instruments.

When the advice or recommendation is given in absentia, the BIS can be made available to clients after the transaction has been concluded, provided that their approval has been obtained beforehand.

5.2 Appropriateness and adequacy of financial services

The obligation of the FSP to verify the appropriateness and suitability of the financial services offered to its clients varies depending on the financial services offered to clients:

Financial services | Verification |

Investment advisory services related to individual transactions, without taking into account the Client's entire portfolio | • the FSP inquires about the Client's knowledge and experience |

Asset management or investment advisory services taking into account the Client's entire portfolio | • the FSP inquires about the Client's financial situation and investment objectives |

Services limited to the execution or transmission of Client orders | • the FSP is not required to verify the appropriateness nor the suitability of the transaction |

Lending for transactions involving financial instruments (Crédit Lombard) | • the FSP informs the Client of the specific risks associated with the use of a “Credit Lombard” • as part of a discretionary management or advisory mandate, the FSP advises on the appropriateness of the amount of credit requested by the Client. If the Client's risk profile is no longer in line with what was originally agreed, the FSP will inform the Client and review the situation with him/her, proposing an alternative solution where possible. |

If the appropriateness or suitability cannot be assessed due to insufficient information from the client, the FSP will notify the client before providing the financial service.

If the FSP assesses that a financial instrument is not appropriate or suitable for a client, the FSP will advise the client against it prior to the provision of the financial service.

In the case of multiple account holders or beneficial owners:

• the elements to assess the knowledge and experience normally relate to the account holders or beneficial owners of the relationship. In certain situations, other persons may be taken into account, such as a representative (at the client’s request), or persons authorized by an operating company;

• the assessment of the suitability is always based on the overall situation of the account holders or beneficial owners of the relationship. Thus, in order to ensure the highest level of protection in accordance with the FinSA, the account holders/beneficial owners will be classified in the category that ensures the highest level of protection (e.g. a joint account opened by a “private” and a “professional” owner will be classified as a “private” client).

5.3 Documentation and rendering of account

The obligation of documentation and reporting means that FSPs:

1. document:

• the financial services agreed upon and provided to clients, as well as the information provided by clients on which the FSP relied to agree upon and provide the financial service

• the fact that the FSP did not conduct any suitability or adequacy checks prior to providing the financial service

• the client’s needs and the underlying reasons for each recommendation, in case of investment advice

2. transmit and report at the request of clients:

• the financial services agreed upon and provided, as well as their costs

• the composition, valuation and evolution of the clients’ portfolios

• the documentation relating to point 1.

5.4 Transparency and diligence in relation to clients’ orders

The requirement for FSPs to be transparent and diligent with respect to clients’ orders means that FSPs:

• uphold the principles of good faith and equal treatment;

• execute clients’ orders in an optimal manner, ensuring the best possible result in terms of costs, speed and quality when executing clients’ orders and taking into account the price of the financial instrument and the costs related to the execution of the order;

• may borrow, as counterparty, the financial instruments from the clients’ portfolios, or transmit such operations as agent, only with the clients’ prior and express consent.

6. Mediation body

Client satisfaction is of utmost importance to CBH. Nevertheless, if CBH does not meet the expectations of its clients, it remains fully available to them to find a concerted solution.

If, despite discussions with CBH, clients find the proposed solutions unsatisfactory, they have the option of contacting the Swiss Banking Ombudsman:

Swiss Banking Ombudsman

Bahnhofplatz 9

P.O. Box

8021 Zurich

Switzerland

This neutral and inexpensive – or even free – mediation body will then examine the request for mediation and the situation in a fair and impartial manner.

Information on the mediation request process is available on the Ombudsman’s website and can be obtained from Relationship Managers.

7. Financial services information

As mentioned in point 2, the Bank offers wealth management, asset management and Family Office solutions. In particular:

• Asset management is based on an asset mana

gement mandate, whereby the client entrusts the Bank with their assets to manage in accordance with the client’s established risk profile and the risk profile of the selected portfolio. Under the asset management mandate, the Bank is the one to make the investment decisions.

• Investment advice is provided by the Bank under an investment advice agreement. The Bank recommends one or more financial instruments to the client, taking into account the client’s entire portfolio, in accordance with the client’s risk profile and the risk profile of the selected portfolio. In the context of investment advice, the investment decision, whether or not it follows the Bank’s recommendations, is the sole responsibility of the client.

• Execution-only means that the client gives a buy or sell order and the Bank executes it.

As part of the provision of its financial services, the Bank informs its clients of the related costs. The client is informed of the costs and fees when the account is opened, by means of the Fees & Commissions brochure, and during the course of the business relationship, by means of any formal decision to apply a particular fee structure.

In addition, further information on the costs related to a financial instrument may be included in the Basic Information Sheet (BIS), or in the prospectus, if such documentation is available for the type of instrument concerned.

In all cases, the actual costs and fees related to the transactions are indicated on the transaction advice.

8. General risks related to financial instruments

Trading and holding financial instruments offer opportunities and come with financial risks. Clients must understand the risks associated with the various instruments they wish to trade and use. To this end, the Bank provides its clients with the SBA’s “Risks of Trading in Financial Instruments” brochure.

This brochure is given to clients when they open an account and is also available on the Swissbanking website. Clients can also request it from their Relationship Manager and ask any questions they may have.

9. Conflicts of interest

A conflict of interest is a situation in which opposing interests conflict. This is the case when the interests of clients, those of the Bank, its employees or other intermediaries, are in conflict. For example, a conflict of interest arises:

• in the context of trading in financial instruments, the Bank’s own interests (income) may conflict with those of its clients;

• when the Bank receives remuneration from third parties with whom it has an economic relationship;

• when the Bank remunerates its employees according to their performance, and intermediaries (insofar as this is authorized).

In order to ensure that these potential conflicts of interest do not put clients at a financial disadvantage, the Bank has implemented measures to prevent and manage such conflicts, including:

• the adoption of organizational measures and procedures aimed at protecting the interests of clients (in particular the establishment of information barriers, separation of responsibilities, reporting and monitoring of transactions, etc.);

• informing clients that the Bank may be an investment fund manager and that, in this capacity, it may receive a management fee;

• informing clients of the ranges of remuneration obtained from third parties with whom the Bank has economic relations; these benefits or remunerations may be related to products held, delivered or purchased at the clients’ request;

• informing clients, whose relationships have been established through third parties acting as intermediaries, of the remunerations or commissions paid by the Bank to these third parties; moreover, if the clients concerned receive services from an independent financial advisor or from an external asset manager while using the Bank for custody services and execution of market transactions, the Bank may pay a portion of the income from this relationship to the intermediary in question.

CBH complies at all times with the principles of its policy on the prevention, management and mitigation of conflicts of interest.

10. Other mentions

This notice is intended exclusively for the clients of CBH Compagnie Bancaire Helvétique SA.

The General Terms and Conditions, any other terms and conditions and any contract entered into with CBH, apply and remain in force.

Although every care has been taken in the preparation and review of this document, CBH does not accept any liability for the adequacy, reliability, completeness or accuracy of its contents, as some of the information provided in this document may have changed since it was given to clients.

Deposit Insurance

Are my deposits protected under the deposit insurance esisuisse?

Yes. Like any bank and any securities firm in Switzerland, CBH Compagnie Bancaire Helvétique is required to sign the Self-regulation «Agreement between esisuisse and its members». This means clients’ deposits are protected up to a maximum of CHF 100,000 per client. Medium-term notes held in the name of the bearer at the issuing bank are also considered deposits. Depositor protection in Switzerland is provided by esisuisse, and the depositor protection system is explained in detail on the esisuisse website.

Last review: January 2022

Special terms and conditions for mobile payments

Mobile payment solutions: Specific terms and conditions

The present terms and conditions apply to the use of CBH credit and prepaid card (“Card”) in mobile payment solutions offered by third parties (“Provider”).

These Specific Terms & Conditions (STC) govern the particular matters regarding the enrolment of the Cards in the applications of Providers allowing mobile payments.

1. Application of the specific terms & conditions

These STC form an integral part of the existing agreements between the Cardholder and the Bank that apply to their card relationship – particularly the General Terms and Conditions for the Use of CBH Cards (“GTC”). The present terms shall prevail in the event of any conflict.

These STC do not govern your contractual relationship to the mobile payment solutions’ Provider which is regulated by their own contractual conditions for the provision of their services. The Bank shall not be liable for any dispute arising from the Cardholder’s relation with the Providers. The Bank shall not be liable and does not offer any support or assistance for hardware, software and other Provider’s products and services, for example the Mobile Device or an application developed by the Provider. Any questions in this regard must be addressed to the concerned Provider.

By agreeing to this document, the Cardholder have accepted these STC.

2. Third parties providing mobile payment solutions

The mobile payment solution is offered by the Provider of the Wallet and/or Device (including its group companies or any commissioned third parties) in accordance with its separate terms and conditions and instructions. The Bank is not the Provider of the mobile payment solution: the Bank merely enables the Cardholder to use the Card in the Provider’s mobile payment solution.

The Cardholder accepts that the Provider may alter or adapt the features of the mobile payment solution at any time at its own discretion and that it may temporarily suspend or permanently withdraw the mobile payment solution at any time. The Bank is not liable for ensuring a functioning mobile payment solution.

The Cardholder is aware that the Bank and the Provider are independent of each other and are independent controllers in relation to the processing of personal data. In this respect, the Provider collects the Cardholder’s personal data itself for its mobile payment solution service. It processes this data in Switzerland or abroad for its own purposes in accordance with its own terms of use and its data privacy notice. The Cardholder acknowledges that it is the independent responsibility of each CBH and the Provider to comply with applicable law and the contractual agreements when processing the personal data. The Bank does not have any influence on the Provider’s data-processing activities and, for this reason, any objections to the processing of personal data by the Provider must be addressed directly to it.

The Cardholder acknowledges and agrees that by storing their Card details in the Provider’s mobile payment solution, the latter’s terms and conditions and data privacy notice apply.

3. Conditions of use of the mobile payment solutions

The service is offered by the Bank free of charge to all Cardholders holding a Card issued by the Bank.

In order to use the service, the Cardholder must own a Mobile Device enabling the use of mobile payment solutions.

4. Card activation and enrolment

The Cardholder may only use Cards that are in their name in the mobile payment solution. In doing so, the Cardholder must also comply with the Provider’s terms and conditions.

The Bank has no obligation to enable the Card(s) for the mobile payment solution. The Card(s) may be activated for use in the mobile payment solution via various channels such as apps, text messaging or phone call. For this purpose, the Bank may send single-use activation codes and information regarding the activation/use of the mobile payment solution to the provided mobile phone number linked to the Cardholder’s relationship with the Bank. These transmissions might potentially result in a disclosure of the banking relationship to third parties (for example network providers).

The Cardholder is entitled to enrol their Card(s) issued in their names on the Mobile Devices they personally own.

In order to use mobile payments services, the Cardholder must own a Device that permits such use. That means that the enrolment of a Card is only possible when the Device with the original software is compatible with the applications, NFC technologies and with the operating system (“OS”) as precised by the Provider. In this regard, the Provider may impose its own limitations and restrictions in the use of its applications. The Bank is not responsible for the inability to use the mobile payment solutions due to the inadequacy of the Device used by the Cardholder.

To use the mobile payment service, the Provider’s requirements must be fulfilled before using the mobile payment solution, such as having a specific account in the Cardholder’s name, connecting to the Provider’s cloud service and/or set a specific screen locking/unlocking method.

After fulfilling the Provider’s required conditions, the Cardholder must activate the CBH Card to register it in the Device:

- the activation of the Card is made in the Provider’s Wallet application by choosing to add a Card; the Cardholder may scan or enter manually the information of the chosen Card (name, surname, Card number, expiry date, CVV code);

- the Cardholder must accept the Provider’s specific conditions related to the use of the mobile payment solution;

- some specific instructions may be displayed; in this case, the Cardholder shall follow them in order to use the mobile payment service. In addition, the Cardholder may be required to enter a unique verification code provided by the Provider, sent to the phone number registered with the Provider.

A Card that has been duly registered and accepted by the Provider can be enrolled on more than one Device at a time, provided that the abovementioned steps are followed for each Device on which a Card is to be enrolled.

5. Use of the Card

Once a Card is registered, the Cardholder can use their Mobile Device for contactless payments and online transactions.

The Provider allows the Cardholder to make payments by using the Token associated with each Device on which a Card has been duly enrolled. Since the Cardholder has the possibility to enrol more than one Card on a Device, each Card has a different Token.

Details about how to use the Mobile Device and the Token can be found on the concerned Provider’s website.

6. Authorization of transactions

Transactions are authorized in accordance with the Provider’s requirements (for example by entering the Card’s PIN). All transactions made with the enrolled Card(s) automatically instructs the Bank to settle the claims of the merchants paid via the Card(s).

The Cardholder can purchase goods and services, in Switzerland and abroad, up to the individual limit of the Card. If the limit is exceeded, the Bank is entitled to block the Card without prior notice.

It is prohibited to use the Cards for illegal purposes.

The Bank reserves the right to change the Cards’ rights, the PIN code, other codes and the Cards’ limit at any time and without having to provide a reason. The limit is shown on the monthly statement.

The GTC for the Use of CBH Cards apply.

7. Due diligence obligations

The due diligence obligations set out in the Bank’s GTC for the Use of CBH Cards apply.

In particular:

- The Cardholder shall protect their Mobile Device against unauthorized access, in particular by locking it;

- The Cardholder undertakes to keep the passwords and any codes confidential (access code to the Wallet, screen unlock code, etc.). Access to their Wallet or their Mobile Devices must be protected by a personal password or code or by other means in accordance with the Provider’s requirements (for example fingerprint or facial recognition).

- In case of loss, theft, confiscation or misuse of the Wallet or Mobile Device, or in case of suspicion of such events, the Cardholder must immediately contact the Customer Service.

- If the Cardholder does not use a Device (any longer), or before switching Devices, they must ensure that the mobile payment solution cannot be used by unauthorized third parties. To do so, the Cardholder shall delete the stored Card data and cancel the specific Token associated to the Card.

- The Bank does not assume any responsibility for the risks associated with the use, correct or improper, authorized or unauthorized, of the Cardholder’s Wallet, Mobile Device and Card details.

8. Data acquisition, processing and transmission to third parties

In order to offer the service, the Bank processes the data received from its clients and generated in the scope of the business relationship with them. The Bank may delegate areas of activity or services to Group companies or external companies (subcontractors), in Switzerland or abroad. The Group companies responsible for processing the card business have the same right to outsource.

This concerns, in particular, the processing of the card business, the creation of documents, card printing, invoicing, collection, and fraud management that can be outsourced in whole or in part. With regard to outsourcing, it could happen that contractual or transactional data are sent to internal or external service providers and that these service providers in turn call upon other service providers.

The Cardholder agrees in particular that these agents have been informed about their personal data if said data are essential for the conscientious execution of the assigned tasks.

All service providers are bound by the confidentiality clauses. If a service provider is based abroad, the Bank or its Group companies will only provide data that do not identify the Cardholder.

When a mobile payment solution is used, international card organizations also obtain knowledge of the same data as when a Card is used in accordance with CBH’s GTC for the Use of CBH Cards (for example purchasing a plane ticket via Internet). The international card organisations will notably be provided with information concerning the Mobile Devices (e.g. device ID) as well as the Cardholder’s personal information required for the use of the Wallet (such as name, address and information concerning the Card(s)). Providers can also obtain knowledge of this data when it is transmitted by CBH in connection with the mobile payment solution to the international credit card organization or third parties. Furthermore, third parties may obtain information concerning devices, notably to provide the Cardholder with an overview of their transactions. International card organizations and third parties process personal data on their own responsibility.

It should be noted that Swiss law (banking secrecy, data protection) only applies in the Swiss territory; data transiting abroad are therefore not protected under Swiss law. For data processed abroad, the Bank is released from its obligation to comply with banking secrecy and data protection.

Detailed information about how the Bank processes personal data can be found in the Bank’s data privacy notice, available on its website (Legal & Credits (CH) – CBH Bank | Compagnie Bancaire Helvétique).

9. Liability

The service provided by CBH is limited to enabling the storage of the Card(s) in the mobile payment solution. The Bank is not liable for any damage caused by using the mobile payment solution unless CBH fails to exercise the appropriate standard of diligence in regards with the use of the Card(s).

All provisions regarding the liability of the Cardholder and the Bank regarding the use of the Cards are lay out in the Bank’s General Terms and Conditions for Cards’ use, as accepted by the Cardholder upon request of a Card issued by the Bank.

10. Amendments to the Specific Terms & Conditions

CBH reserves the right to modify the STC at any time. CBH also reserves the right to change the rates, commissions, costs and fees at any time, without having to provide a reason. The amendments are communicated to the Cardholder by circular letter or by any other appropriate means. Amendments are considered approved if the Cardholder does not raise any objection within 30 days after the communication date.

11. Contact

In the event of loss, theft, non-receipt, confiscation or misuse of the Card, or if such events are suspected, the Cardholder must contact the Bank’s Customer Service immediately without taking the time difference into account at telephone number + 41 800 00 55 44, available 24/7, and request that the card be blocked. The Bank is not responsible for the consequences that may result from the blocking of the Card.

For any questions related to the activation of the mobile payment solution, the Cardholder can find more information on the concerned Provider’s website.

For information related to the transactions carried out via the mobile solution, the CBH Cardholder can contact their dedicated CBH Relationship Manager.

12. Place of performance and jurisdiction

These STC are exclusively subject to Swiss law. Any dispute shall be brought before the exclusive jurisdiction of the Courts of the Canton of Geneva subject to appeal at the Swiss Federal Court in Lausanne. The Bank nevertheless reserves the right in all circumstances to bring the case before the authorities or the competent court of the address for service at the Cardholder’s usual place of residence or any other competent jurisdiction. In either case, only Swiss law remains applicable.

____________________________________________________

DEFINITIONS:

Bank or CBH: CBH Compagnie Bancaire Helvétique SA.

Card: prepaid / credit card

Cardholder: the Card account holder to whom a Main card is issued.

Partner: the person for whom the Cardholder requested, and the Bank agreed the issuance of an additional Card with access to the Cardholder’s card account.

Main card: the electronic payment instrument issued in the Cardholder’s name.

Partner Card: a card issued to another person than the Main Cardholder, at the request of the Main Cardholder

Specific terms & conditions (STC): these terms & conditions.

Mobile Payment Solutions: digital wallet app, offered by the Provider, through which the Cardholder can make Token payments using mobile devices compatible with the dedicated app. Additional information on the app and compatible devices can be found on the Provider’s website. This app is offered to the Cardholder under a separate agreement concluded between the Cardholder and the Provider.

Face ID: facial recognition of the Cardholder using a Mobile Device with security authentication based on advanced technologies that enable precise face geometry identification.

Find My Device app: application of the Provider designed to locate the devices.

Provider: third party providing mobile payments solutions via the wallet and/or device. Their terms & conditions apply.

NFC: high frequency radio communication standard that enables wireless data exchanges over very short distances, of up to 20 centimeters.

Token: unique series of digits in digital format that ensures secured data substitution for a Card enrolled by the Cardholder on a Provider’s device. The Token can be used to make contactless payments using the NFC technology, or for online payment on the websites and in the apps of vendors that accept card payment by displaying the Provider’s mobile payment option. The Token number is different from the number on the front of the enrolled Card. The Token ensures increased transaction security, avoiding card number storage by vendors.

Touch ID: recognition of the Cardholder as possessor of the Mobile Device by using a digital fingerprint.

Touch ID, Face ID, Find My are trademarks of Apple Inc., registered in the U.S. and other countries and regions.

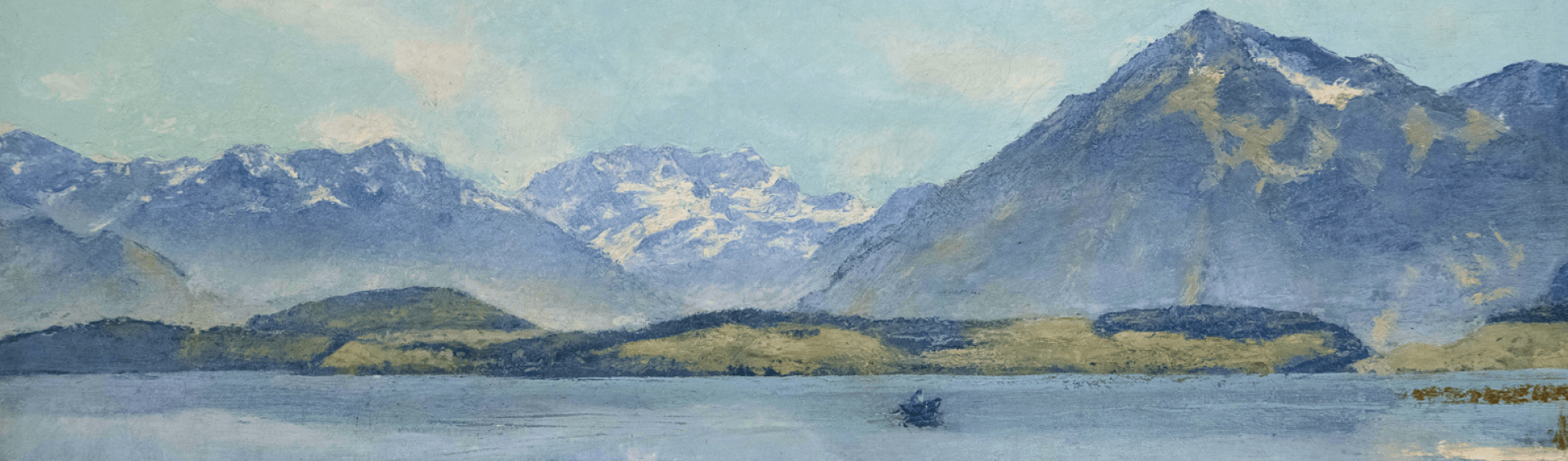

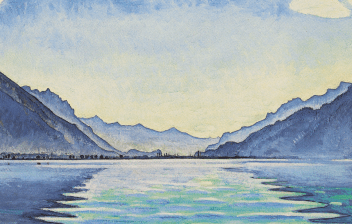

Artworks Credits

As a Swiss Private Bank, CBH Bank is proud to promote the Swiss cultural heritage. In the context of our partnership with the Musée d’Art et d’Histoire of Geneva, we are putting forward a selection of paintings by the renowned Swiss artist Ferdinand Hodler. Ferdinand Hodler is considered to be the Swiss artist that has had the most influence on the painting of the end of the nineteenth and the beginning of the twentieth century. As ardent admirers of the Arts, we also pride ourselves on having gathered through the years, a beautiful private collection of artworks by both traditional painters, as well as some younger, more contemporary artists.

LE LÉMAN VU DE CHEXBRES Ferdinand Hodler Around 1904. Oil on canvas, 80 x 100 cm © Musée d'Art et d'Histoire de Genève - City of Geneva Photo: Yves Siza | |

LE LAC LÉMAN ET LE MONT BLANC (LA RADE DE GENÈVE ET LE MONT BLANC À L’AUBE, AVEC CYGNES) Ferdinand Hodler 1918. Oil on canvas, 77 x 152.2 cm © Musée d'Art et d'Histoire de Genève - City of Geneva Photo: Yves Siza | |

LE LAC DE THOUNE AUX REFLETS SYMÉTRIQUES Ferdinand Hodler 1905. Oil on canvas, 80.2 x 100 cm © Musée d'Art et d'Histoire de Genève - City of Geneva Photo: Bettina Jacot-Descombes | |

LE QUAI DES PÂQUIS À GENÈVE Jean-Baptiste Camille Corot Around 1842. Oil on canvas 34 x 46 cm © Musée d'Art et d'Histoire de Genève - City of Geneva Bequeathed by Mr and Mrs Frédéric Mayor in 1919 Photo: Yves Siza | |

LE LAC DE THOUNE, LE BLÜEMLISALP ET NIESEN Ferdinand Hodler 1853-1918. Oil on canvas, 38 x 55 cm © Private Collection CBH Compagnie Bancaire Helvétique Photo: Pascal Bitz | |

LA JUNGFRAU VUE DE MÜRREN © Musée d’Art et d’Histoire - City of Geneva Photo: Yves Siza | |

FÉLIX AUBLET © Private Collection CBH Compagnie Bancaire Helvétique Photo: Pascal Bitz. |